Old College Capital (OCC) is the University of Edinburgh’s venture investment fund.

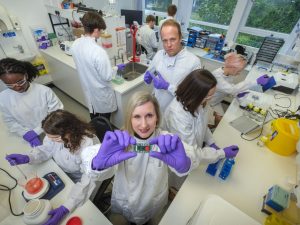

We manage Edinburgh’s early-stage investment activities and shareholdings; supporting exciting ideas and technologies emerging from the University.

We invest responsibly and are in it for the long-term, working with founders, investor partners, and the University ecosystem, to help build disruptive, ambitious and sustainable companies.

This is why founders and over 150 investors, choose to work with us.

We invest from pre-seed to Series A stages, to accelerate the journey of startups and spinouts looking to make a positive impact on people and our planet.

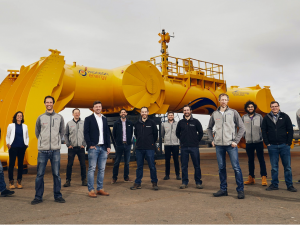

OCC has a diverse portfolio of over 80 disruptive companies, developing cutting edge technology to deliver high impact ideas.

We are an experienced team of deep-tech, early-stage investment specialists, passionate about getting ideas from our staff, students, and research out into the world where they can make a difference.

OCC is part of Edinburgh Innovations, the University of Edinburgh’s commercialisation service.

OCC is a signatory of the Investing in Women Code, a commitment by financial services firms to improving female entrepreneurs’ access to tools, resources and finance.